A CRM platform that provides a secure and efficient way for peer-to-peer lending processes. The system also provides a range of tools and services to help borrowers, lenders, and syndicates to manage their loans and earn a return on their investments.

Leverage LendWizely to expand your lending enterprise.

Sales/Leads

Effortlessly integrate your sales/ISO systems with LendWizely by leveraging our Rest API or a selection of connectors, ensuring smooth and streamlined application process.

Loan offers

LendWizely CRM empowers ISOs by providing them with the flexibility to choose personalized offers and generate contracts dynamically in real-time. Streamlining the process, LendWizely ensures ISOs can efficiently cater to their clients’ needs while accelerating their workflow.

Account retention

Renew agreements effortlessly with a simple click, utilizing our advanced technology that facilitates seamless document retrieval and sends reminders to your ISOS and merchants. Enjoy swift funding for renewals within 24 hours, with a hassle-free process.

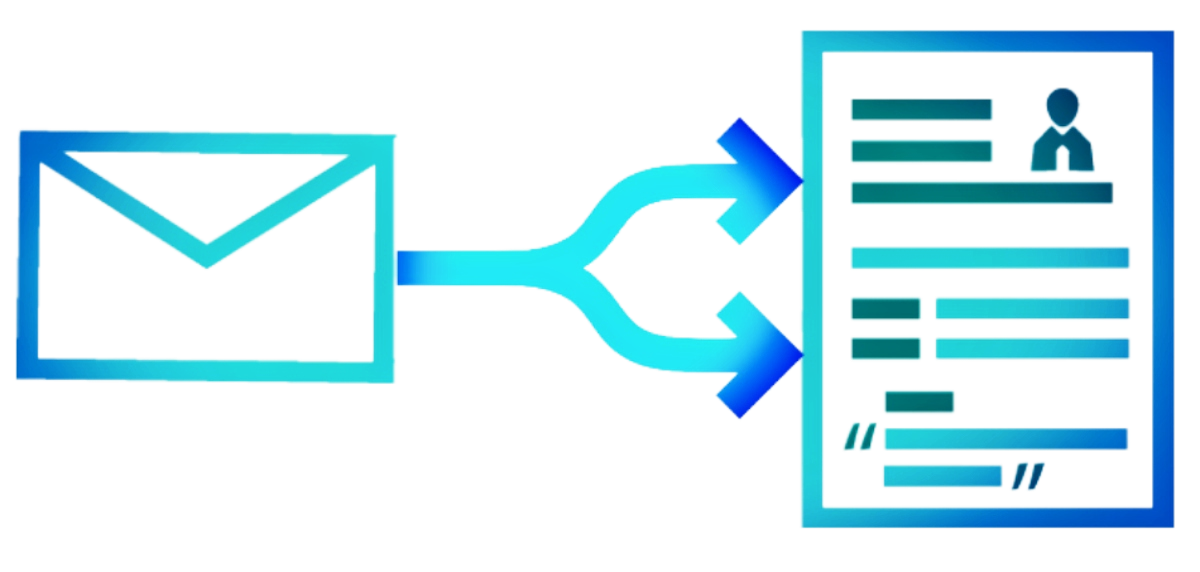

Email parsing to your CRM

-

Our system automatically parses attached documents from your email and extracts notes, swiftly determining whether the submission was previously processed or involves a new company. All email attachments are seamlessly saved into your designated S3 bucket or Dropbox and conveniently linked to the relevant loan application.

-

In mere seconds, our cutting-edge file control sheet employs Optical Character Recognition to automatically analyze bank statements, swiftly detecting deposits, transfers, daily balances, as well as any cash advances, loans, or potentially suspicious activities.

Contracts & Whitelabels

Discover the full potential of LendWizely CRM, where optimized processes and enhanced time efficiency are achieved through seamless integration of eSignatures and pre-filled contracts. Embrace a streamlined workflow that eliminates paperwork, saving valuable time and resources. Effortlessly upload and utilize multiple contract templates, customizing your Whitelabel accounts within seconds to foster meaningful engagement with your esteemed partners. Experience unparalleled CRM support, unlocking the true capabilities of Whitelabel Accounts for your business.

Credit Analyst & Offers

Lendwizely simplifies the tasks of credit analysts and underwriters by providing pre-calculated solutions. The highlight is our offer simulator, which offers a dynamic method for establishing customized guidelines effortlessly. With just a click, you can simulate various offers and terms before finalizing. This empowers our isos/merchants to swiftly respond with a counteroffer or acceptance using a simple button click. Contracts are sent out promptly, and funding is secured in under 24 hours.

Underwriting

Our underwriting dashboard simplifies and accelerates the tasks of underwriters by integrating company search tools, SOS connections, background checks, and the option to save outcomes for companies/merchants. With a streamlined overview, the platform empowers underwriters to efficiently handle tasks like Merchant Interviews and funding calls, enhancing decision-making and optimizing the underwriting process.

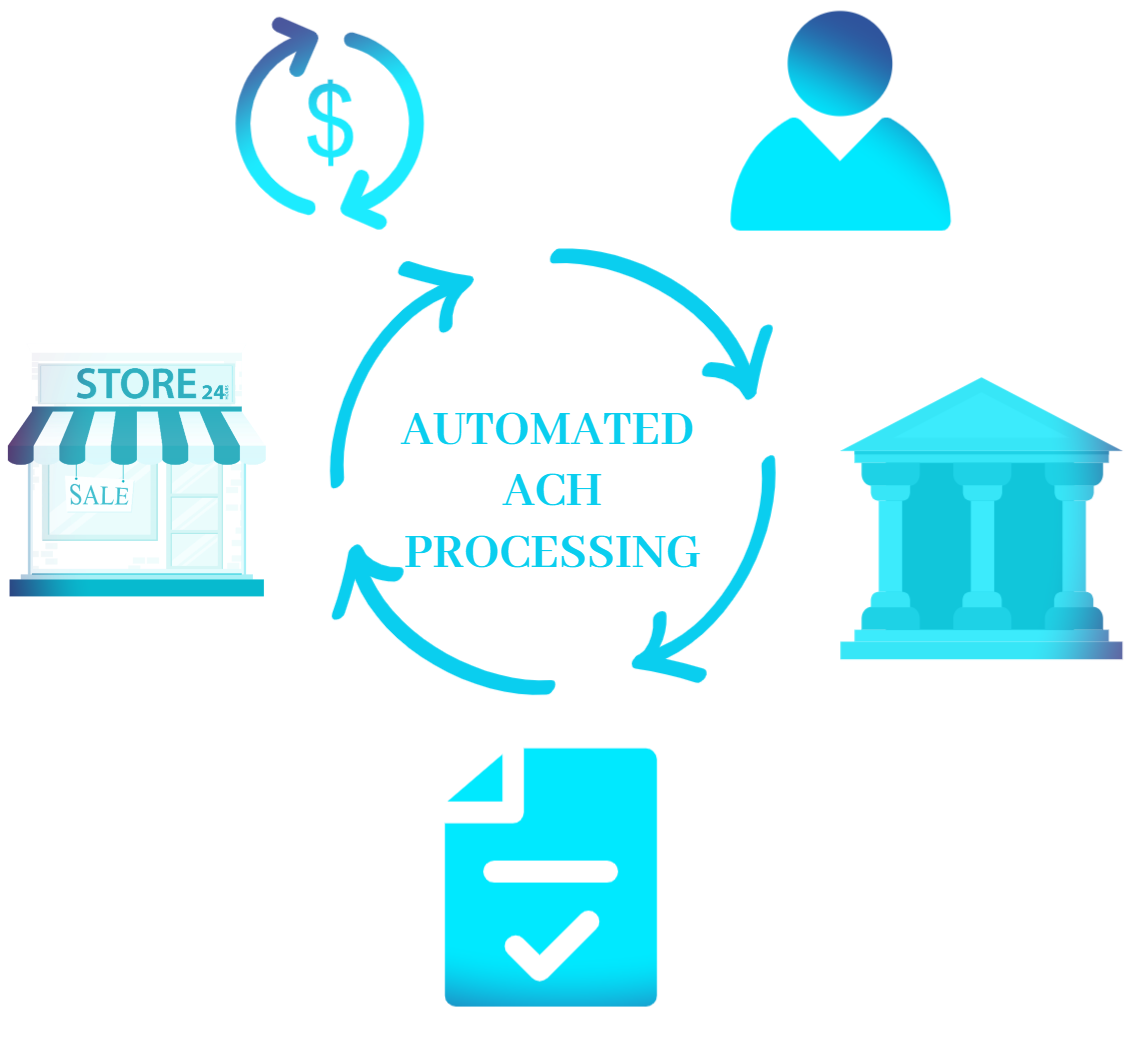

ACH processing

ACH Processors and Credit Card Processors facilitate daily collections seamlessly.

Reporting

Execute Quality Control, retrieve Closing Stats, and obtain valuable Insights into your accounts.

Collections

Our CRM enhances the collections process for your team by providing a dashboard that allows them to effortlessly monitor each deal’s performance and payment percentage. They can conveniently filter results by performance and directly initiate follow-ups with merchants from the same dashboard. The system also empowers collections to track recent bounced payments (NSF/Returned transactions) and coordinate revised payment schedules or alternative methods with merchants. For up-to-date insights, the latest NSF/Returned transaction report is automatically updated on their dashboard every morning. Additionally, if a collector successfully retrieves owed payments from a merchant, they can accurately record their commission in a dedicated table, serving bookkeeping purposes.

Development Support

At Lendwizely, our dev support is second to none. Our team of skilled and experienced developers is always ready to provide comprehensive assistance for our company site. Whether it’s resolving technical issues, implementing new features, or optimizing performance, we are committed to ensuring that your experience on our platform is seamless and user-friendly. With prompt and reliable support, we aim to exceed your expectations and make your journey with Lendwizely a smooth and rewarding one.

Dedicated ISO & Syndication Portal

-

Ensure your ISOs are always up to date with our dedicated ISO portal – a website exclusively designed for them. They can log in and effortlessly submit deals directly through their personalized portal, as well as track the status of their commissions and deals with ease.

-

Grant your syndication partners a login to access their deals and pipelines, and even enable them to participate in new deals under development. Our system offers a detailed breakdown of cash balance and a plethora of additional features for enhanced visibility and control.

Safe and secure

Your security is our top priority. We go above and beyond to safeguard our clients’ information, employing a powerful combination of cutting-edge technologies like proxies, XDR agents, and firewalls. These multiple layers of advanced security ensure that your data is shielded from any potential threats. With us, you can trust that your information is in the safest of hands, providing you with peace of mind throughout your entire journey with Lendwizely.

Underwriting and parsing process

How a submission comes in via parsing and goes out

1. Parsing

The email application is parsed directly into our system.

2. Scrubbing

Bank accounts are automatically scrubbed into our detailed file control sheet.

3. Offer is sent

A Credit Analyst generates an offer based on payback capability, sends it, and Underwriting completes the analysis, contracts, and finalizes the funding process.

Grow Your Business Easier

Use our tools to manage your loans and earn a return on your investments.

Why Choose Us

Grow Your Business Easier

Use our tools to manage your loans and earn a return on your investments

Contact Us

Start Your Demo Today

Contact us to request demo

Give us a call

(844) 843-3170

Send us an email

Address

104 East 25th St, Floor 10, New York, NY 10010